By Everett Ballenger We recently looked at the various price brackets of what homes were selling for in the five areas (the

MoreBy Janet Gresham There has been a general slowdown in home sales across the country, and this cannot be blamed on negative

MoreRealtor certified in military relocation Robert Moul, of Weichert, Realtors-Coastal Properties, has been awarded the nationally recognized Military Relocation Professional Certification by the

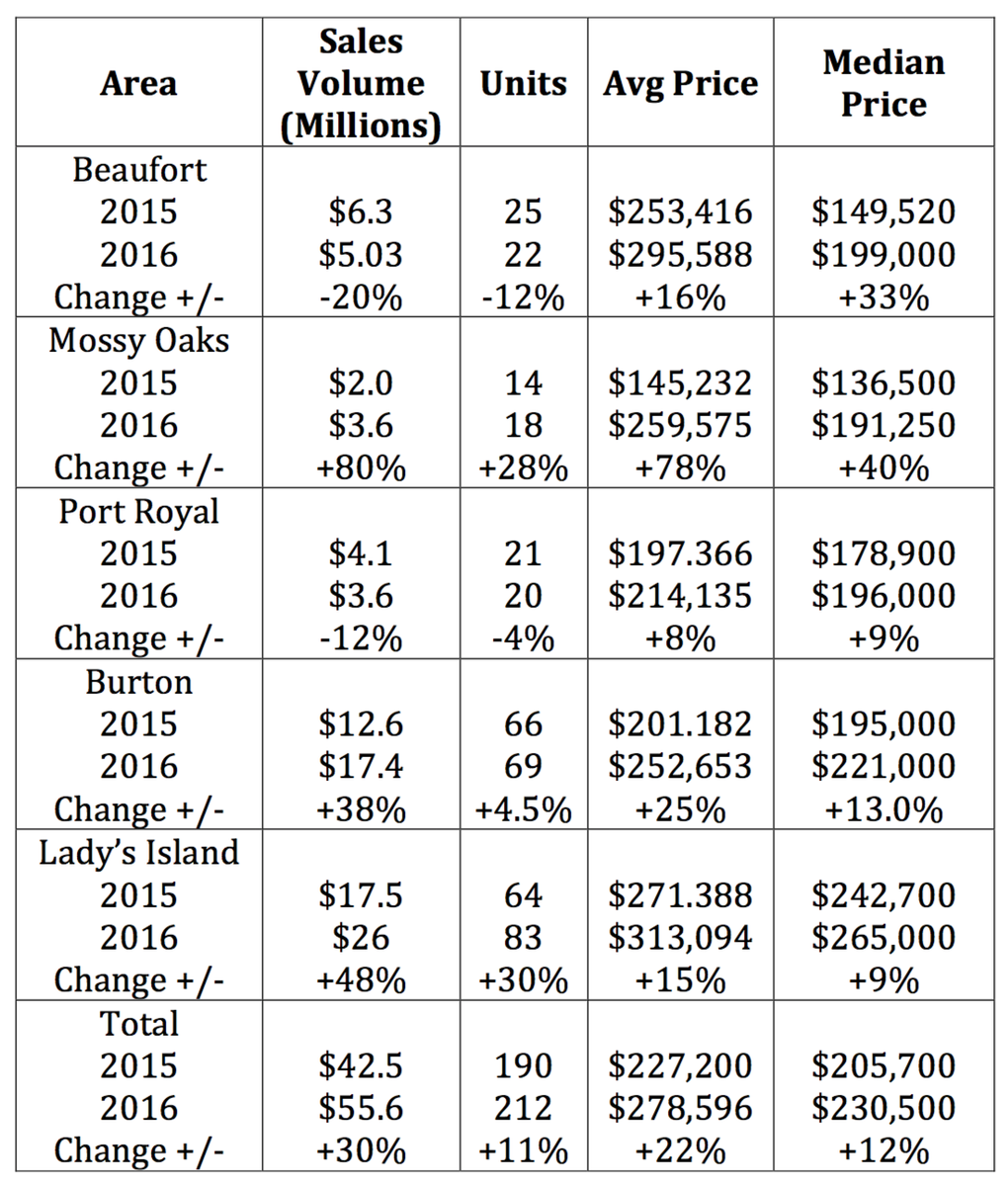

MoreBy Everett Ballenger 2015 was a landmark good year for Ballenger Realty and I suspect also for many other Beaufort real estate

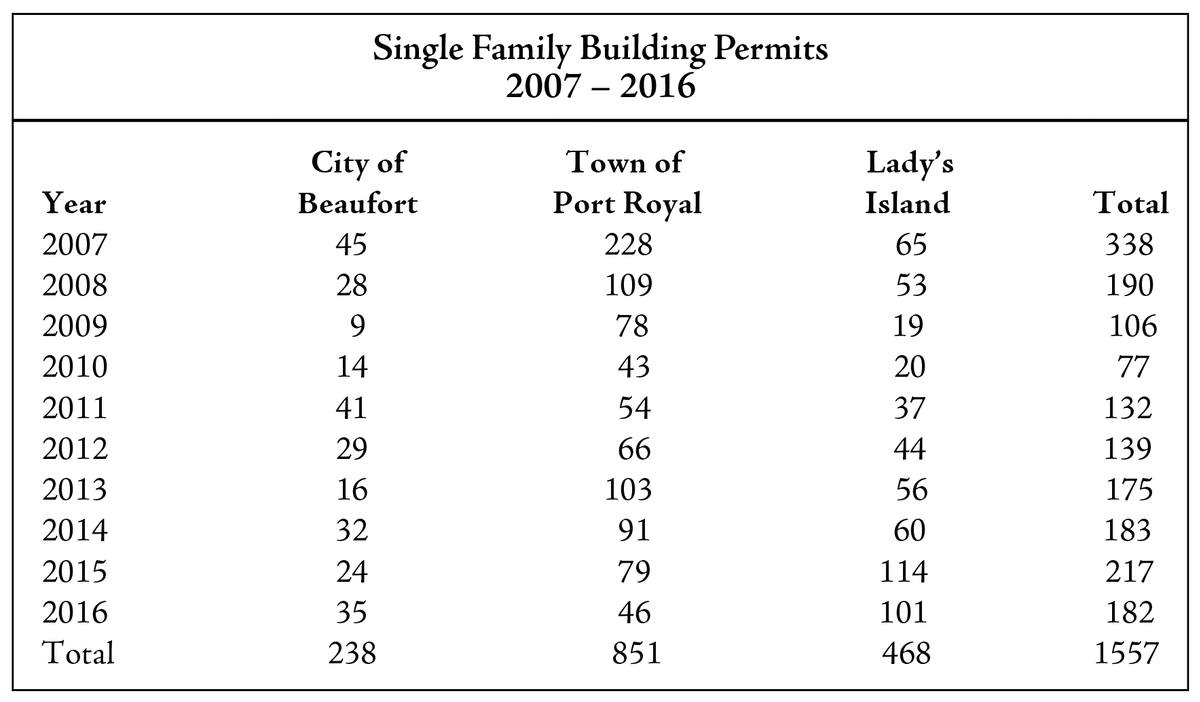

MoreBy Lady’s Island Business and Professional Association Prior to the 2007 crash of both the economy and the housing market, Lady’s Island

MoreBy Everett Ballenger The first three quarters of 2016 were especially strong for real estate in Northern Beaufort County, excepting September, which

More