By Lanier Laney

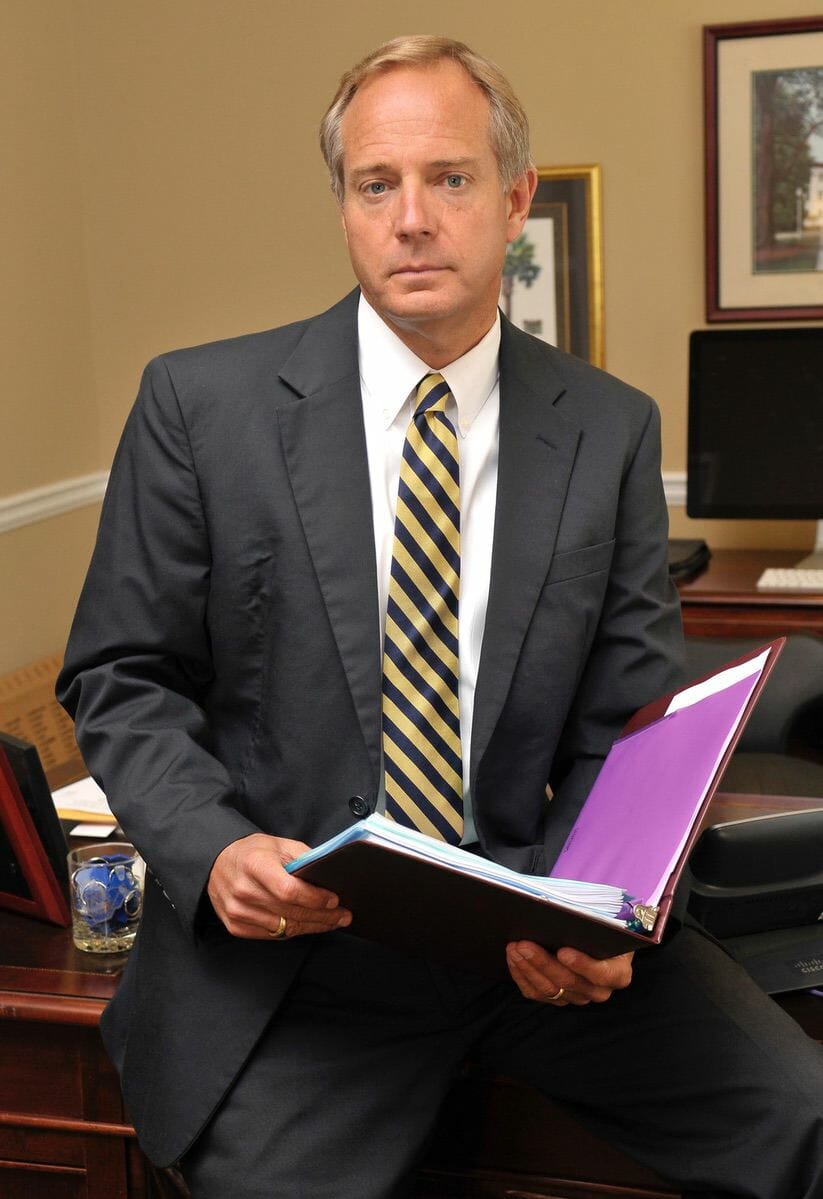

Philip Fairbanks grew up in the Philadelphia area, graduated from Temple University, and earned his law degree at Catholic University in Washington, D.C., where he served on the Law Review.

Following graduation in 1977, he hopped on a train headed for his first job as a staff attorney with the federal Legal Services Office in Beaufort. He never looked back and today his deep knowledge of the region informs his judgment.

Phil found his specialty in bankruptcy, an area where he feels he can make a personal difference helping solve financial problems when it is needed most. For the past 15 years, Phil estimates he has filed cases for more than 2,000 people from Beaufort, Bluffton and Hilton Head as well as throughout Hampton, Jasper and Colleton counties. In his spare time he likes to garden, get on the river, and travel with his wife, Dale Friedman.

Says Phil “We have helped people of all ages, professional achievement, and income levels who come to us because they can no longer keep up with their debt without some help. Many are burdened by medical expenses for themselves or loved ones; some have been laid off in a poor economy; others have experienced family upheavals like death or divorce. Similarly, in this economy, small business owners find the pressures of meeting payrolls, tax obligations, suppliers’ demands, while continuing to make a profit, increasingly difficult.

Our clients are a diverse group with a common problem, but each and every case is unique. Our firm enjoys the challenge of designing the right solution for each client, whether it is through bankruptcy or another alternative that will allow them to address their financial difficulties and make a fresh start.”

Adds Phil, “Bankruptcy can be a process full of stress, details and deadlines, and to best meet the needs of our clients, we’ve assembled a seasoned group of co-workers who contribute in any number of ways every day to make sure our clients are prepared, informed and treated with kindness and respect.”

“When I walked into Phil’s office, I was embarrassed about my bankruptcy and ashamed and feeling like I’d failed. But when I walked out, I felt a huge weight had been lifted off my shoulders and I so appreciated his comforting words and help,” said a client.

Many people drop health insurance, cash in retirement savings, lose homes, and suffer overwhelming stress rather than file. Bankruptcy is a responsible, legal procedure for resolving debt-related problems. The bankruptcy laws provide relief to those who can demonstrate to a federal judge that, despite their best efforts, they will not be able to manage unless their debt is restructured or eliminated.

Most people who file for bankruptcy legally eliminate a substantial amount of their debt that would otherwise show up on their credit report. Overall, the new credit report — minus the discharged debt — looks better to new potential lenders than the old one. Many people find that their credit actually improves following a bankruptcy.

There are two types of debt: ‘Unsecured’ and ‘Secured’. Unsecured debt is not backed up (secured) by collateral and includes things like credit card and finance company accounts, medical bills, utility and cell phone accounts, and some kinds of income tax debts. Secured debt has something tangible (collateral) behind it: a car, boat, furniture, some installment purchases, and perhaps biggest of all, your home. Chapter 7 and Chapter 13 bankruptcies, also known as “consumer bankruptcies,” have different requirements as well as advantages and disadvantages.

How Filing for Bankruptcy Can Save Your Home

A Chapter 13 can make it possible for homeowners who are several months or more behind on their mortgages to keep their homes by resuming the regular monthly mortgage payment and making a small additional payment to “catch-up” the unpaid balance over a five year period. This is possible because bankruptcy reduces the amounts a homeowner is required to pay on other, usually unsecured debts (credit cards, medical bills, etc.). Typically, those other debt balances can be reduced by up to 95%.

A Chapter 13 bankruptcy can also allow homeowners who are struggling with a home equity loan or second mortgage to substantially reduce the monthly note payment.

Alternatively, a Chapter 7 bankruptcy can simply “wipe out” all unsecured debts, making it possible for a homeowner who is current or only slightly behind on a mortgage to keep the home.

Phil’s office is at 1214 King St. and he can be reached at 843-521-1580.